Maintenance > Human Resources > Benefits Administration > Benefit Plans Maintenance > New/![]()

Use the tabs on this page to set up and maintain a benefit category and associated plan information.

Note: Once a benefit category has been used in a payroll, the ability to edit or delete it is disabled.

The fields on this tab define a benefit category. Some fields are common to all benefit categories, while others are specific to a category.

To see descriptions of common or category-specific fields, click the appropriate link below:

| Field | Description |

|---|---|

| Category Name |

Required. Full name of the benefit category. This name must be unique and may contain letters and numbers. Once the category has been saved, this name cannot be changed. |

| Description | Detailed description of the benefit category. It may be the same as the Category Name and may contain letters and numbers. |

| Type |

Read-only field containing the category type, i.e., Medical, Dental, selected in the Benefits Administration Category-New pop-up when the category originally is added. This entry determines the number and types of fields that display below the Payroll Dates. Note: The Type field is read-only when the page is in edit mode. |

| Status | Identifies the category as Active or Inactive in the system. |

|

Coverage Options The available coverage options are determined by the Effective Date of the benefit category. All of the options that have not been assigned to the benefit category are listed in the left (Available) multi-select box. All of the options that have been assigned to the benefit category are listed in the right (Selected) list box. To assign an option to the benefit category, select it in the Available box, and click the right-arrow button to move it to the Selected box. To remove an option from the benefit category, reverse the process. Note: If the benefit category has a Last Used in Payroll date, the list boxes are disabled. Note: Once a category has been used in a payroll or assigned to an employee who has a payroll date that is equal to or later than the category effective date, the category cannot be edited. After making your selections in the multi-select list boxes, click the Save button on the Category tab. |

|

| Coverage Effective Dates |

Shows the date range during which the benefit category is in effect. The current category typically shows <Open> in place of an end date. When you use the Create Event button to select a new Coverage Start Date, an end date is applied to the current benefit category. If a category contains multiple effective-dated records, gaps may not exist between effective date ranges. The start date of a category may not be changed to a date later than the first date the category was used in a payroll. Use the arrow buttons on either side of the Coverage Effective Dates field to navigate between the different effective date ranges of a category. All related plans, options and rule sets remain in sync with the date range selected. On first opening this page from the Benefits Administration Categories page, the currently effective record for the category displays. |

| Coverage Dates | |

| Coverage Start Date |

Required. First date the coverage for this category is effective. Note: Once this date is saved, the field is locked, and the date may be changed through the Create Event option only. |

| Payroll Dates | |

| Payroll Start Date |

Required. Determines the actual start of payroll deductions for the selected coverage. For a category to be eligible for selection in a cafeteria plan, the Payroll Start Date of the category must coincide with the Payroll Start Date of the associated cafeteria plan. Note: Once this date is saved, the field is locked, and the date may be changed through the Create Event option only. |

| Payroll End Date | Last date payroll deductions are taken for the selected coverage. |

| Last Used in Payroll | Read-only. Last date the category was used in a payroll. This date is read-only. The payroll post date updates it. |

| Field | Description |

|---|---|

| Calculation Limits | |

| YTD Limit Start Month | Payroll and position budgeting calculations determine year based on YTD Limit Start Month and compare with period end date; for example, if January is selected as the YTD Limit Start Month, the year is January 1 - December 31. For the period end date year of January 1 - December 31, the calculation sums all benefits and deductions tied to the plan and determines whether they are at the maximum limits. |

| Single HDHP Coverage | Required. Contribution limit for an employee with self coverage in a high deductible health plan (HDHP). |

| Family HDHP Coverage |

Required. Contribution limit for an employee with family coverage in an HDHP. Note: The employer contributions on the Cost Entry page are annual maximum contributions for employers; therefore, separate plans are not required for employee and employer contributions when the frequencies differ, thus allowing the utilization of the annual plan maximum on the category page |

| Over 55 Catch-up | Catch-up contribution limit for an employee 55 years old or older. |

| Bank Account | |

| Require for Enrollment | Determines whether employees are required to us the Default Bank selected for employee HSA accounts. |

| Allow Override of Bank | |

| Default Bank | Required if Allow Override of Bank is not selected, default bank to be used for employee HSAs. On the selection of a bank, the Routing Number fills in automatically. |

| Routing Number | Routing number of the Default Bank. This number fills in automatically on the selection of a Default Bank. |

| Default Account Type | Required if Allow Override of Bank is not selected, the default account type, Savings or Checking, for the HSAs. |

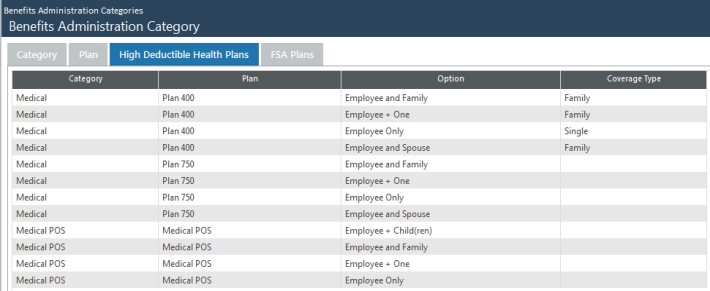

The High Deductible Plans tab contains a grid of the medical plans that allow an employee to enroll in an HSA. It contains all medical categories, plans and options available on the start date of the selected health savings account.

The user is able to specify whether an item is single HDLP, family HDLP or non-HDLP.

The FSA tab contains a grid of medical care reimbursement plans. An employee enrolled in a selected FSA plan may not be enrolled in an HSA category.

The user is able to select the plans that exclude an employee from enrolling in an HSA.

Notes

- When an event is created on a health savings account, the values of the HDHP and FSA tabs are copied to the new event.

- Changes to the HDHP and FSA tabs for one event on a health savings account do not affect other events for the same category.

- An event and category for a health savings account may be deleted with HDHP and FSA plans selected.

| Field | Description |

|---|---|

| General | |

| Track Beneficiary Information | Determines whether to track data related to beneficiaries of the policy. A checked or unchecked box carries forward as is when a new effective-dated category is created through the Create Event function. |

| Field | Description |

|---|---|

| Dependent Tracking | |

| Track Covered Dependents | Determines whether to track information related to dependents covered by this benefit category. |

| Dependent Child Age Limit | Enabled only if Track Covered Dependents is checked, maximum age a child may be covered as a dependent. |

| Dependent Child in School Age Limit | Enabled only if Track Covered Dependents is checked, maximum age a dependent child in school may be covered, if the associated benefit plans allow for additional coverage of students. |

| Calculation Limits | |

| YTD Limit Start Month | Payroll and position budgeting calculations determine year based on YTD Limit Start Month and compare with period end date; for example, if January is selected as the YTD Limit Start Month, the year is January 1 - December 31. For the period end date year of January 1 - December 31, the calculation sums all benefits and deductions tied to the plan and determines whether they are at the maximum limits. |

| Minimum Annual Contribution | Determine contribution limits specific to medical and dependent care reimbursements. |

| Maximum Annual Contribution | |

| Pay Period Limit |

Tells the system whether to verify that a contribution limit is being met per pay period. Note: This feature may be used to prevent the election of the maximum yearly amount when enrolling well into a plan year, then using the benefit and leaving the job soon after. |

| Field | Description |

|---|---|

| General | |

| Track Beneficiary Information | Determines whether to track data related to beneficiaries of the policy. A checked or unchecked box carries forward as is when a new effective-dated category is created through the Create Event function. |

| Calculation Limits | |

| YTD Limit Start Month | Payroll and position budgeting calculations determine year based on YTD Limit Start Month and compare with period end date; for example, if January is selected as the YTD Limit Start Month, the year is January 1 - December 31. For the period end date year of January 1 - December 31, the calculation sums all benefits and deductions tied to the plan and determines whether they are at the maximum limits. |

| Annual Total Limit | Annual dollar limit for benefits and deductions combined. |

| Annual Employer Limit | Annual dollar limit for benefits in the plan category. |

| Annual Employee Limit | Annual dollar limit for deductions in the plan category. |

| Allow Over-Age Catch-Up | Determines whether employees older than 50 may make additional contributions. |

| Additional Limit | Enabled if Allow Over-Age Catch-Up is checked, maximum additional dollar amount an employee may contribute or defer. |

| Allow Last Year's Catch-Up | Determines whether an employee may make additional contributions in the last three years before retirement. These contributions are applied to years the employee did not contribute the full, allowable amount. |

| Annual Additional Limit | Enabled if Allow Over-Age Catch-Up is checked, maximum yearly amount an employee may contribute in the last three years before retirement. |

| Retirement Tracking (Retirement button on Benefits Administration Category tab) | |

| Track Interest | Determines whether actual retirement balances are tracked for employees. |

| Interest for Current Year (Complete) |

Enabled if Track Interest is checked, information used for attaining an accurate look at retirement balances.

|

| Interest for Current Year (Partial) | |

| Prorate Partial-Year Payments | |

| Interest for Prior Years | |

| Vesting Date Type |

Enabled if Track Interest is checked, date type on which the vesting schedule is based. A vesting schedule accurately portrays the employer's portion of an employee's retirement payment. Click in the field to select from a drop-down list of the following date types: Accrual Date, Benefit Date, Hire Dateand Seniority Date. This selection enables the Vesting Schedule button. |

To see what a button does, click its image below:

For the selected benefit category and effective-dated period, plans that already have been set up display in this centrally located grid, sorted alphabetically by Plan Name, with columns displaying their descriptions, plan years and providers. Validated plans show check marks in the Validated column; invalidated ones show red Xs.

To see what a button does, click its image below:

Note:

To add a benefit plan to the grid, click the New button, located in the bottom border of the grid. To edit a benefit plan, click the edit icon (![]() ), located in the cell immediately to the left of the Plan Name. In both cases, the Benefits Administration Plan Entry page opens.

), located in the cell immediately to the left of the Plan Name. In both cases, the Benefits Administration Plan Entry page opens.

Use this page to set up and maintain all of the details of a benefit plan.

Note: Once a benefit category has been used in a payroll or assigned to an employee who has a payroll date that is equal to or later than the effective date, the ability to add or edit an associated plan is disabled.

To delete an entire benefit plan, including its associated options, selected payment frequencies and all effective-dated versions of the plan, click the delete icon (![]() ), located in the far-left cell of the corresponding row. A dialog asls you to confirm the delete.

), located in the far-left cell of the corresponding row. A dialog asls you to confirm the delete.

After the delete, the end date of the prior plan record is adjusted to the day before the next effective-dated period begins, data for the current plan record populates the page, and the grid on the Benefits Administration Categories page updates accordingly.

Note: Once a plan has been used in a payroll or assigned to an employee, the delete icon is hidden.

Use this tab to specify opt-out amounts for selected benefit categories when the employee is enrolled in a benefit credit category.

| Column | Description |

|---|---|

| Eligibility |

Eligibility status for the employees. Enter all eligibility statuses that are assigned to employees. If you do not use the concept of eligibility, make only one entry here. For a given eligibility, only one opt out credit may be specified for a pay group. Note: The combination of Eligibility and Pay Group must be unique. |

| Pay Group |

Employee pay groups that receive opt out payments. Multiple opt out credits may be specified for a pay group (one for each pay group). Note: The combination of Pay Group and Eligibility must be unique. |

| Frequency | How often credits or deductions are taken. |

| Number of Payments | Total number of payments withheld for the plan year for the corresponding pay group. |

| Hours Code | Required, though not used for benefit credits. |

| Credit Amount | Annual amount. |

Note: When you create an event for a category that includes an opt out, the opt out data from the previous event carries forward to the new effective date.